Table of Contents

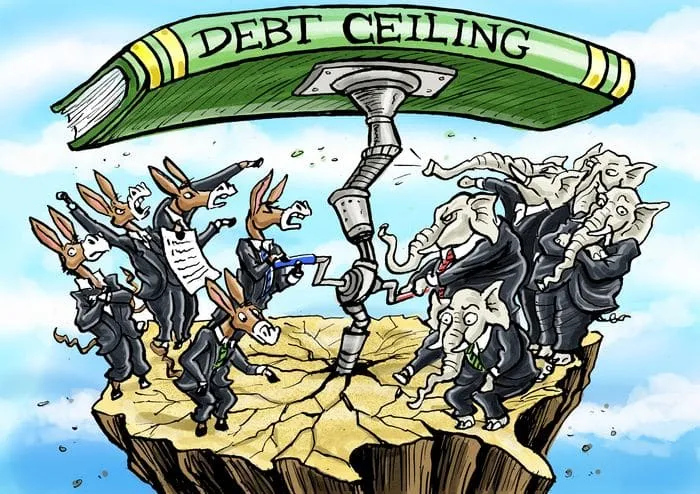

America faces a debt wall.

Towering at $38 trillion, our national debt is now 25% larger than the entire economy. It’s slated to grow by at least $1.8 trillion this year alone, possibly by more if the Supreme Court declares Trump’s tariffs unconstitutional. Just interest on the debt cost the US almost $1 trillion this year, eclipsing all military spending.

Markets are taking note. For the first time in modern economic history, our debt is no longer considered risk-free, as Microsoft and Johnson & Johnson enjoy higher credit ratings and lower interest rates than the US government.

Which is why we must abolish the debt ceiling.

Abolish?

Counterintuitively, the debt ceiling has fueled the debt problem by manufacturing fiscal emergencies that undermine US creditworthiness and force panic-driven, budget-busting deals. Nixing the ceiling would remove a key driver of our increasingly-unsustainable debt levels.

The debt ceiling is a legal limit on how much the federal government can borrow to pay its existing obligations—spending that Congress has already approved in previous budgets. In theory, it should force fiscal responsibility. When borrowing hits the cap, Congress must cut spending or raise taxes; otherwise, the government couldn’t borrow to pay interest on existing debt, triggering a default, a calamity no legislator can risk.

But the debt ceiling is far from a serious check on irresponsible borrowing. Raising or suspending it 12 times since 2011, legislators fail to take it seriously: only twice were ceiling increases paired with bills targeting deficit reduction, and not once did they target a balanced budget. Each increase already assumed the next.

In practice, instead of restricting borrowing, the ceiling drives deficit spending. It holds the entire federal budget hostage with the panic-inducing threat of default; this hard deadline makes passing any budget paramount. Deficit-laden deals become more likely because the fastest way to secure congressional votes is to promise spending increases for holdouts’ districts and ideological projects. And as suspending the ceiling requires three-fifths of the Senate, while most budgets require a simple majority, these compromises are even more vulnerable to holdouts. Thus, Republicans and Democrats will strike profligate grand bargains that raise spending equally for each party’s preferred departments, as in 2015, 2018, and 2019.

The debt ceiling’s threat of default uniquely creates these deficit-swelling compromises. Political parties pass policy priorities like tax cuts and “inflation reduction” via party-line reconciliation budgets, where procedures restrict deficit spending; meanwhile, all but one major bipartisan budget since 2011 has come out of a debt ceiling crisis.

Tallying the spending changes in legislation accompanying each debt ceiling hike yields damning results.

The cuts: $459 billion in 2011; $7 billion in 2017. The increases: $80 billion in 2015; $296 billion in 2018; $320 billion in 2019; $183 billion in 2023.

In all, the debt ceiling produced $466 billion in cuts, but a whopping $879 billion in new spending. This understates the damage. For one, Congress excels at accounting gimmicks; more sophisticated accounting that disregards budgetary tricks estimates the 2019 deal alone added $1.7 trillion to the debt, five times the sticker price.

For another, the debt ceiling makes all government borrowing more expensive by undermining America’s creditworthiness, further swelling the debt. When the ceiling is inevitably hit, it creates the risk of catastrophic default, spooking investors. Two of America’s three credit rating downgrades came directly from debt ceiling crises: one citing “political brinksmanship” in 2011, the other citing “deteriorating governance” in 2023.

These downgrades aren’t symbolic. Each one pushes up borrowing costs, partly because regulatory restrictions make it harder for international pension funds to hold US debt. More fundamentally, they signal eroding confidence in American institutions—eroding confidence that forces the US to pay higher interest rates on all future borrowing.

Fortunately, both President Trump and prominent Democrats support abolishing the debt ceiling. When the next debt ceiling hits in 2026 or 2027, both parties will hopefully band together to kill this costly abomination.

For better or worse, our way of life relies on our “exorbitant privilege” to cheaply borrow and inflate our living standards. To risk this—to heap needless trillions in debt, to invite a debt crisis—just for the illusion of fiscal responsibility would be a monumental blunder.