Table of Contents

Frugality is suddenly in vogue again. And strangely enough, it is the Democrats who are trumpeting the message of fiscal responsibility here in our beloved great state of California, a state whose dysfunctional government for years has fought over finding the path from “present fiscal difficulties” to “healthy state government.”

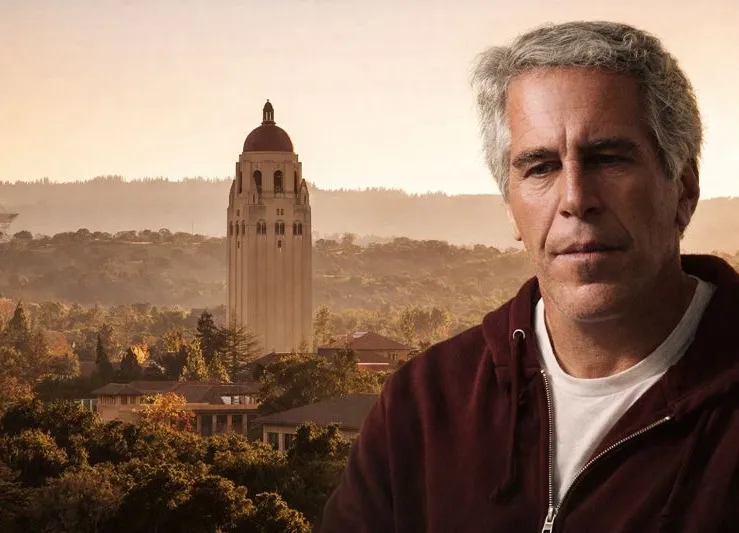

Stanford students live in a state whose fiscal woes are always an exaggerated version of the nation’s. While America is growing worried about endless deficit spending, California is worrying about much more: default and disaster.

And yes, California’s fiscal health matters to the health of our state economy. The majority of Stanford students will end up undergoing their job searches in the state’s perennially weak job market. In fact, California’s remarkably unfriendly business climate, compounded by its lack of fiscal self-discipline, results an outpouring of the state’s small businesses and corporations, as they pack up shop and move elsewhere rather than suffer within the Golden State’s tax and regulatory systems.

Governor Jerry Brown, famous for his frugality and justifiably proud of his record in “cutting spending more than Ronald Reagan did in his eight years as governor,” is embarking on a bold course of poisonous spending cuts that will, at some level, alienate most of his interest-group supporters. This will be unpopular and may cost him his political future. The governor is about to prove to us whether he can sacrifice some of his standing with his Democratic base in exchange for accomplishing something good for his state.

But there are some troublesome signs already. Brown’s budget proposal includes $12.5 billion in spending cuts, but it also contains a special election ballot measure asking voters whether to extend temporary increases in the personal income, sales, and vehicle taxes. For one, this proves that Brown has not tried or succeeded in weaning us off our unhealthy addiction to direct democracy by referendum.

Also, the tax extensions would be for five years and raise $9 billion through June 2012. But in the long run, the tax increases could undo much of the progress Brown should be hoping to achieve for our state. Brown must work with a Democratic legislature which is often reflexively hostile to closing off the spigot of taxpayer dollars that, in their minds, is a perpetual free lunch. He may bow to his base by raising taxes, but if these tax increases are passed, it is easy to see that they cannot easily be revoked after being in place for five years.

Mayors who say the cuts will cost jobs, and health and welfare advocates who say the changes could cost lives have already salvaged the budget cut proposals. Their criticisms are all too true. However, the state is in a crisis and has no choice but to make deep spending cuts and extend temporary tax increases to close a budget deficit projected to be $25 billion over the next 18 months. As Brown said, “Sometimes when you pull the Band-Aid off, it’s better to do it quickly.” This will let California get past the pain and position itself for a long-term recovery that could ensure we never again dig the hole so deep again.

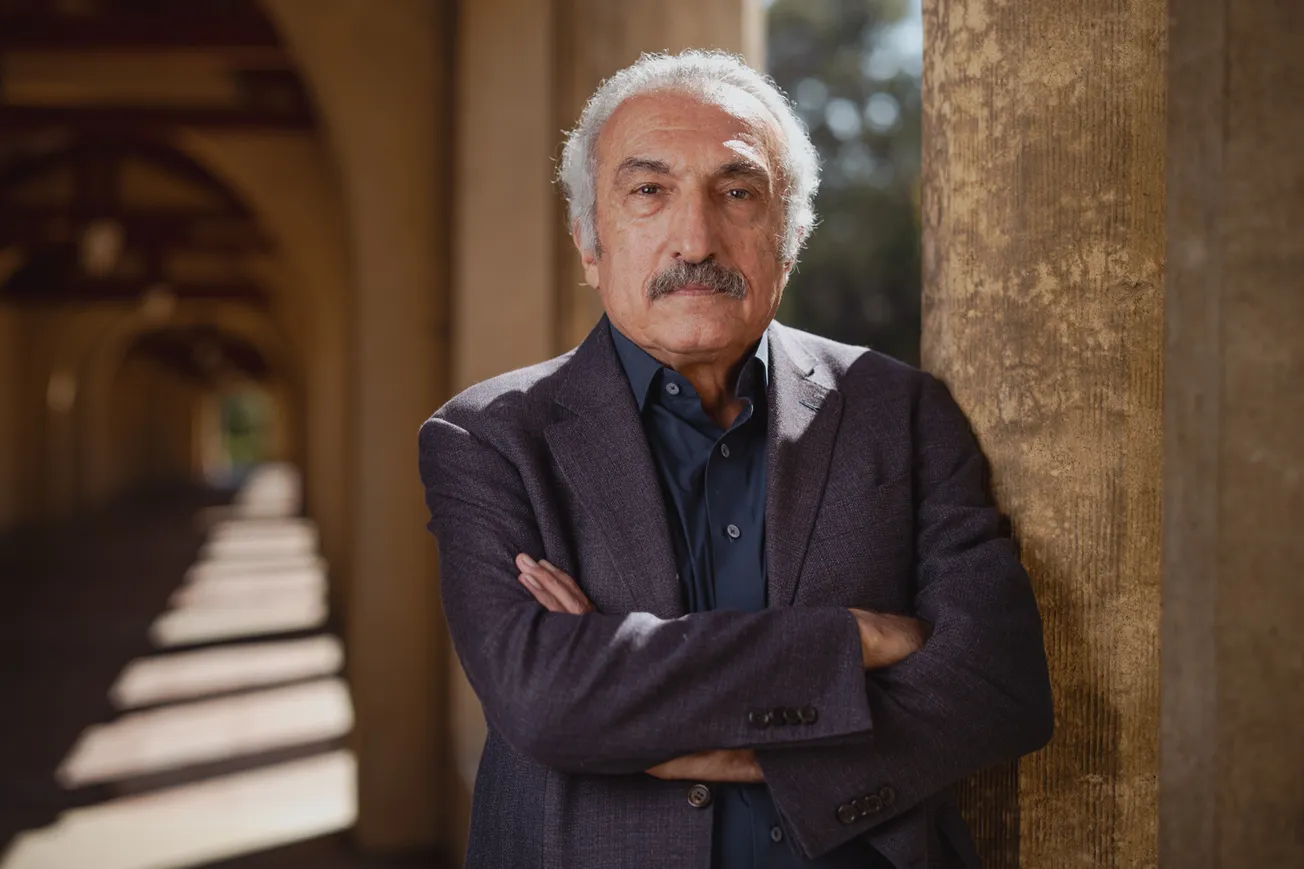

Vasant Ramachandran ’11 is majoring in Electrical Engineering. He can be reached at vasantr@stanford.edu.