Table of Contents

You’d expect the Mafia to be debanked, but when even members of the PayPal Mafia are debanked on a whim, it’s time to sound the alarm.

In 2019, Roelof Botha—Managing Partner at Sequoia Capital and an early PayPal executive—found himself unexpectedly “debanked” by the Bank of America, a bank that holds $2.55 trillion in assets. With no explanation provided and no clear route to appeal, he was left bewildered and frustrated.

Botha—in an exclusive interview with the Stanford Review—described his frustrating experience with Bank of America. He noted that he “did not wish to wait for them to mail [him] the amount while they paid [him] no interest on the balance.” Every attempt to escalate met with “a stony reply at every turn. ‘We can’t tell you why’ was what [he] kept hearing,” an obviously unsatisfying response for any customer.

Later, he learned that federal AML laws bar banks from disclosing the precise reasons behind certain account closures: “If a drug cartel is laundering money, it is understandable that the government doesn’t want to tip them off. But this seemed like overreach.”

Botha’s story is hardly unique. With increasing frequency, individuals and businesses alike face sudden and unexplained account closures. While anti-money laundering (AML) regulations are necessary to combat illicit financial activity, it’s becoming apparent that regulatory overreach, fueled by strict AML laws, both harms innocent individuals and stifles innovation. Even worse, government influence finds a way to discriminate against industries that are legal but inherently controversial and partisan like cryptocurrency and cannabis.

Debanking has deep historical roots. Since the 1930s, three- and four-letter government agencies have tried to rein in banks and credit unions to punish those deemed undesirable—whether they be “politically exposed persons” (PEPs) or merely individuals whose viewpoints or industries run counter to current political winds.

A prime historical example is the Home Owners’ Loan Corporation (HOLC), founded in 1933 as part of Franklin D. Roosevelt’s New Deal. The HOLC created color-coded “Residential Security” maps designating entire neighborhoods as “high-risk.” This practice, known as redlining, was specifically intended to prevent black people from living in white neighborhoods by denying them the critical financial tools—mortgages, refinancing, and insurance—they needed to purchase and maintain property. As a result, these communities were systematically cut off from mainstream lending, mirroring a proto-version of “debanking.”

Over time, other agencies and programs followed this exclusionary blueprint, often arising in the aftermath of economic crises yet ultimately broadening the reach of regulatory overreach.

Fast-forward to the 21st century, and Operation Choke Point, launched around 2013-2014 in the Obama administration, took aim at what federal regulators labeled “high-risk” industries such as firearms, payday lending, and tobacco. Banks and payment processors, fearing backlash or investigations, quietly severed ties with businesses in these sectors, even when those businesses operated lawfully. Today, “Choke Point 2.0” under Biden’s administration now targets emerging industries, with crypto and state-legal cannabis dispensaries now caught in the crosshairs.

The newest and perhaps most visible “offender” in the regulatory landscape is the Consumer Financial Protection Bureau (CFPB). Established under the Dodd-Frank Act of 2010 in response to the 2008 housing crisis, the CFPB was intended to consolidate consumer protection duties that had previously been scattered across entities like the Federal Reserve, the Federal Trade Commission (FTC), the Federal Deposit Insurance Corporation (FDIC), the National Credit Union Administration (NCUA), and the Department of Housing and Urban Development (HUD). Yet, in practice, the CFPB added another layer of complexity to an already convoluted financial regulatory system—one that is easily exploited to “encourage” banks to deny services to lawful businesses deemed politically unpalatable.

When government agencies decide who can and cannot bank, they wield an outsized power capable of stifling innovative industries at the whim of archaic regulators.

Debanking is driven by “jawboning,” or the informal pressure regulators exert on banks without official directives or explicit legal mandates. No formal rulemaking process or court orders are involved; rather, unchained regulations “encourage” bank executives, behind closed doors, to sever ties with industries they deem “high-risk.”

Once labeled as such, a company is systematically denied banking services—or subjected to abrupt account closures—thus becoming functionally unbankable. Without access to basic banking, businesses cannot pay employees or vendors, process credit cards, or engage in routine financial transactions, effectively ending their operations.

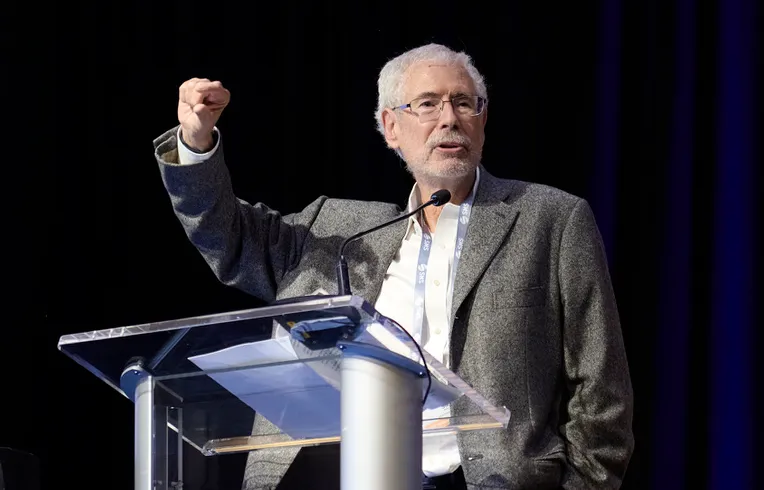

Botha traces this crisis to “regulatory overreach.” Venture capitalist Marc Andreessen has become one of the most vocal critics of debanking, especially concerning the crypto and decentralized finance sectors. Andreessen, in a recent interview, explained that around thirty a16z-backed tech founders have faced debanking in the past four years alone, often without explanation or any path to appeal. For emerging industries—particularly blockchain and crypto—debanking is existential. Without banking, day-to-day operations become impossible. Payroll stalls, vendor payments lapse, and the business quickly collapses. In effect, regulators kill innovation by blocking access to financial services. Policies that don’t have a significant legislative mandate are pursued by overzealous agencies at the behest of political cronies.

Banks have signaled that they would change if regulators gave them the green light. Speaking to CNBC, Brian Moynihan, the CEO of the Bank of America that debanked Botha explained, “If the rules come in and make it a real thing that you can actually do business with, you’ll find the banking system will come in hard on the transactional side of it.” He added, “We have hundreds of patents on blockchain already; we know how to enter the field.” Institutions like Bank of America are eager to explore new financial frontiers, yet regulatory obstacles have created a climate where even leading executives like Botha can be unceremoniously cut off without any stated reason.

Economist Ronald Pol’s research reveals that AML regulations intercept only about 0.1% of criminal funds globally—despite a global compliance expenditure of over $300 billion annually. The cost-benefit gap is staggering, with roughly $3 trillion laundered worldwide each year, yet only $3 billion of that intercepted. In other words, every dollar spent hunting illicit money yields a mere fraction of a fraction in recovered criminal proceeds. The bulk of compliance costs falls on banks and, by extension, legitimate customers.

This overly broad approach to AML, with its heavy reliance on automated “suspicious activity” flags, frequently ensnares innocent businesses and individuals, triggering unexplained account closures, delays in fund transfers, and unwarranted reputational harm. Victims have little recourse:

“Innocent victims…end up severely affected, with no clear remedy or compensation.”

One of the simplest and most impactful reforms would be prohibiting regulators from pressuring banks outside formal legal channels. Through executive orders or legislation, the government could require financial watchdogs to avoid targeting lawful industries or individuals based on politics or personal bias. Botha suggests that “the president should appoint financial regulators willing to investigate ongoing and past abuses.” Given Trump’s longstanding interest in cryptocurrencies, he has already installed David Sacks as an “AI & Crypto Czar,” ensuring that these reforms will likely become a decisive regulatory priority.

Because AML laws prohibit banks from revealing when they file Suspicious Activity Reports (SARs), those wrongly targeted remain in the dark. A delayed disclosure mechanism where relevant details are eventually made available if no criminal behavior is found would maintain investigative secrecy while providing essential transparency for the innocent. Additionally, current rules provide no way to challenge or reverse an account closure. An independent review board could address appeals, ensuring truly suspicious cases remain flagged while “allowing innocent victims to pursue remedy through the justice system.”

Addressing the debanking crisis requires action from all fronts. The executive branch can issue firm orders against blacklisting lawful businesses based on political or moral judgments and appoint leaders committed to correcting past overreach. Legislators can rein in overly broad AML statutes, curtailing false positives and prioritizing genuine threats. Crucially, victims of wrongful debanking deserve a mechanism for compensation—so that errors or abuses have real consequences and genuine redress is possible.

Finally, when the financial system is weaponized—for political or bureaucratic ends—trust erodes. This goes well beyond economics, touching on civil liberties: a government that can quietly remove individuals or businesses from financial lifelines can also stifle dissent or minority viewpoints.

Roelof Botha’s ordeal at Bank of America is but one example among many. Looking back on the incident, Botha later speculated that his multiple cash withdrawals just under the $10,000 threshold—during trips to South Africa for family funerals—might have triggered Bank of America’s suspicion that he was trying to dodge Currency Transaction Report (CTR) requirements. “I believe the bank concluded I was trying to circumvent the need to file the report,” he said, calling it an instance of regulatory “overreach.”

While one can remotely understand the rationale behind anti-money laundering rules, the secrecy that prevented the bank from explaining its actions left him little recourse. Reform—spanning executive orders, legislation, and a deeper cultural change in the regulatory apparatus—is urgently needed to restore fairness and public confidence in our financial system.

That appears closer than ever before. With Donald Trump back in the Oval Office, he brought with him a stark pro-crypto stance. Moreover, his appointment of Mark Uyeda as active chair will redefine the US Securities and Exchange Commission (SEC) and overhaul its stance on cryptocurrencies.

At its core, this is more than an economic question. A financial system that fails to serve everyone ultimately serves no one. Therefore, tackling debanking is not merely a regulatory matter; it is a moral responsibility crucial to preserving the rapid pace of technological progress that underpins a healthy democracy.