Table of Contents

Stanford’s endowment has been under close scrutiny in the last year. Multiple divestment campaigns, from divestment from fossil fuels to divestment from companies operating in the West Bank, have questioned Stanford’s ethical responsibilities when investing its capital. Recently, Stanford’s Board of Trustees opted not to consider the ASSU’s divestment resolution. The Board’s ethical responsibilities are important in part because the university’s investments significantly affect both Stanford and the world: they finance programs for students and faculty and carry immense symbolic power around the world. Despite its importance and role in recent campus debates, many students have little knowledge of how Stanford’s endowment actually works.

Stanford’s endowment aims to provide stable income for the university, independent from market forces and university operational revenue. It encapsulates the adage that “it takes money to make money.” To create an endowment, an institution must have surplus funds that it does not need for its short-term operations. Thus schools with wealthier alumni and profitable operations are generally able to accrue larger endowments than schools with a smaller donor base and bloated operations. The size of endowments across universities vary greatly: some can be relatively large like Stanford’s ($21.4 Billion) and Harvard’s ($35.8 Billion), while others at smaller institutions are in the millions. In the last 20 years, Stanford has made growing its endowment a priority, emphasizing the long-term future of the school. Stanford’s endowment is the fourth largest of United States institutions of higher education, behind Harvard, Yale, and the University of Texas system.

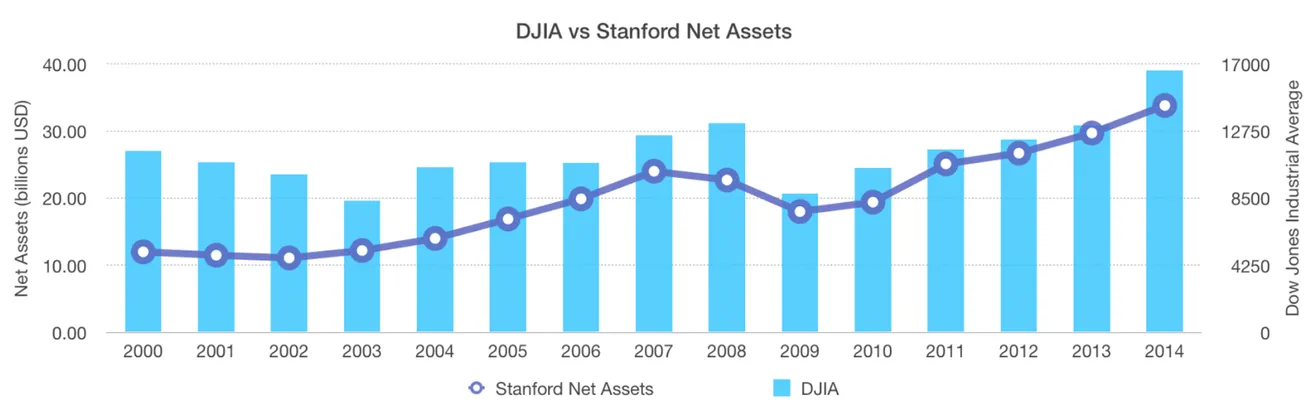

Stanford grows its endowment in two primary ways. One method of growing its endowment is from the returns from the investments made with the endowment funds, the other is to receive direct gifts from its alumni, parents, and other donors. In 2013, Stanford fundraised more than any other American university. These gifts contributed to Stanford’s net assets, more than doubling them in the last ten years from $14.0 billion to $33.8 billion. Gifts to the endowment fall into one of two categories: restricted and unrestricted. Restricted gifts are for a certain purpose specified by the donor while unrestricted gifts are used at the discretion of the university. 22 percent of gifts to Stanford are unrestricted; the rest are tied to a specific program. The Stanford Board of Trustees determines how much of the endowment to spend in a given year and where to spend that money. Stanford’s $18 billion endowment is not quite the size of Harvard’s at $36.4 billion, but Stanford’s expenditures seem to be distributed more favorably towards its students and faculty. Stanford uses 62 percent of its operating expenditures on employee salaries and benefits, compared to Harvard’s 49 percent. Stanford also uses 23 percent of its endowment to cover financial aid; the two schools use $130 million and $182 million towards their financial aid, respectively. This could be partially because of the demographics of Stanford’s student body.

Donations to the university have stagnated yet Stanford’s endowment continues to grow: the income from the endowment far outweighs the gifts the university receives in any given year. Last year, the university received three times as much from the return on its endowment as it did from expendable gifts. Even so, the short term performance of Stanford’s investments is largely irrelevant; their long term performance has led to a doubling of the endowment and the university’s assets since 2000, partially as a result of the Stanford Management Company.

Stanford invests most of its net assets in the Stanford Management Company (SMC), a company created in 1991 to manage the endowment and university finances. SMC is a formidable investor. The SMC has significantly outperformed the S&P 500 – an index of the 500 largest companies in the United States – in the last ten years, earning 10 percent on average per year compared to the S&P’s 7.3 percent. Stanford has invested over $6 billion of its $27.8 billion into “private equities” which it defines as as “investments primarily in venture capital and leveraged buyout strategies.” SMC’s relative success could be in large part from the privileged position that Stanford has as a private investor: Stanford is perceived as one of the most valuable investors, since the university’s endowment is both large and stable.

Stanford’s investments are not solely profit-maximizing; social considerations are also taken into account. Since 1971, Stanford’s investments have been monitored by APIRL, the Advisory Panel on Investment Responsibility and Licensing. APIRL aims to prevent “substantial social injury” in their investments, according to their website. The panel has advised against certain investments in the past. Last year, for example, they encouraged divestment from coal. APIRL pacifies both students and donors that worry about the use of the endowment investments.

As groups ranging from Fossil Free Stanford to Students for Justice in Palestine continue to push for divestment, it is important for Stanford students to become knowledgeable on how Stanford’s endowment works so they can participate in critical conversations.

Update: We have fixed typos to reflect accurate endowment figures.