Table of Contents

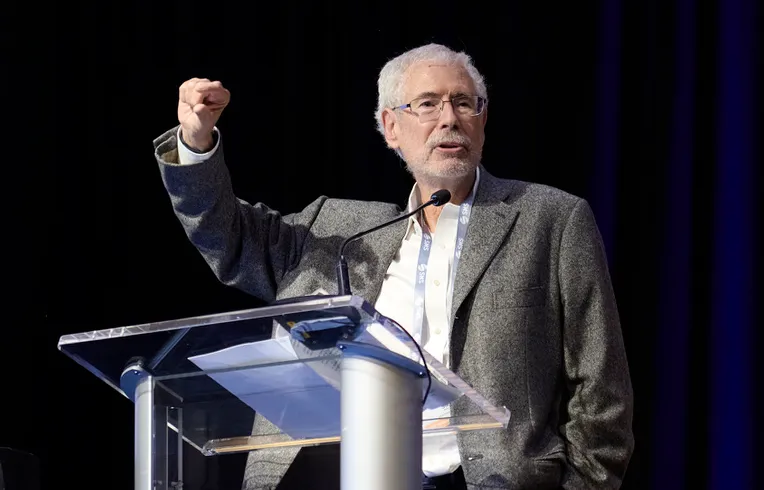

“We don’t feel putting more into venture capital will yield good results. We feel the industry is overfunded in some cases with too much money.”

This is certainly an odd stance for a university located in the heart of Silicon Valley that is by virtue of its location steering people into these industries (the wikipedia on “venture capital” even has a section on Sand Hill Road. But maybe this is just a movement back to more austere times when we could not afford to gamble our money hoping for another Google, or a YouTube that actually makes money (wait, maybe it does).

Hennessey was not quite as bluntly opposed to venture capital as that single out of context quotation might lead one to believe (sorry about that). He also said during the fireside chat (really) that Stanford’s strategy is narrowing its focus to proven winners and small firms that can provide guidance to startups:

Stanford is still staying with some “platinum firms” but is otherwise looking for smaller firms that can provide hands-on assistance for entrepreneurs.

“We also look for small firms with partners with lots of operational experience to work with companies at the very early stage,” Hennessy said.

Apparently Pres. Hennessey does not believe young Stanford alums forming startups to succeed in the open market, which is unfortunate, but as Henry Kissinger used to say, it has the added benefit of being true. The good old days really are over though, aren’t they?