Table of Contents

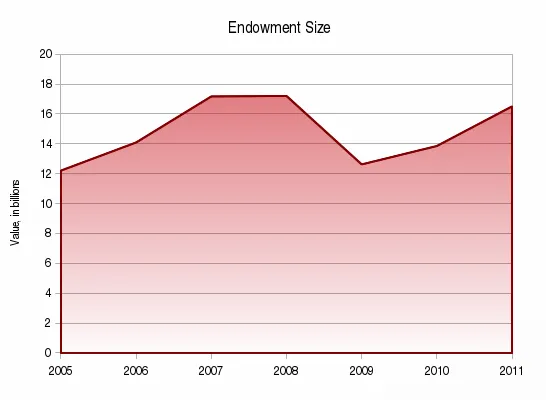

With returns in the order of 14.4% and 22.4% the past two financial years, the Stanford fund has regained more than $4 billion of the $5 billion lost in the infamous 2008 collapse. With a value of $16.5 billion at the end of the fiscal year according to the annual report the Stanford Management Company publishes, the endowment is within sight of the $17.2 billion peak value of the fund four years ago.

The SMC, which oversees the Merged Pool (MP) that constitutes the majority of the endowment, has repeatedly stated that, “Diversification remains the cornerstone of our investment strategy.”

The growth of the endowment is not a function of solely investment returns, however. The university receives an annual paycheck from the endowment, which funds 20% of the university’s annual expenses, and totaled $820 million for the 2011–2012 year. The 2008 drop highlighted the fallibility of this dependence of the fund though, and Stanford, like nearly every other elite private institution, undertook measures to limit their dependence on the endowment for operating expenses.

When the market crashed in 2008, Stanford attempted to decrease its operational dependency on contributions from the endowment fund. In 2009, the endowment provided for 27% of University revenues. That figure has been decreased to 20% in the time since.

“If we have several years of robust investment returns,” said Randy Livingston, the Chief Financial Officer of Stanford, “then the proportion of endowment payment will likely increase and could approach or exceed the prior percentage.”

As the endowment recovers, Stanford is slowly backing away from policies enacted to weather the storm of the crash. Fifty professorships and other faculty positions that were frozen, are now slowly reopening.

“We expect to unfreeze several of these positions in Engineering [this year] and in Humanities and Sciences [next year],” reads the new budget plan report.

The Board of Trustees has also outlined a plan to build a new “Geobiology” department. “This is a breakthrough area in the Earth Sciences, and Stanford has unique assets that will allow the school to build a leading program,” it claims.

These efforts to resume growth only hint at the engine of expansion reviving at Stanford. Despite the economic damage of 2008 becoming increasingly less visible, every category of spending the University outlined for this year has risen from the previous year, despite income failing to keep pace. So what have we learned since the market collapse?

Stanford’s financial leaders seem to have received the same spending wake-up call that every other institution received. This year, “avoiding adding back expenses that were cut over the prior two years, with the exception of faculty positions” serves as the first of four principles determining the budget’s allocation of funds.

The fact that this seems to be one of the few signs of restraint remaining, though, demonstrates a surprising result: Stanford has recovered faster than any projections and suffered less from financial crisis than bleak numbers in 2008 suggested. Not only does the endowment stand poised to grow faster than it ever has, should its performance over the past two years continue, but the success of the Stanford Challenge, which raised $6.23 billion, ended with giving increasing in the 2011 financial year after declining for the past four.

“Stanford went into the 2008 financial crisis in a relatively conservative position… and took prompt action as the crisis unfolded. Our overall mindset has not changed substantially” Livingston concluded.

With giving on the rise, the endowment growing in leaps and bounds, and the Board of Trustees confidently re-expanding programs, Stanford has almost healed from financial distress and sits on the edge of new growth.