Table of Contents

Dear fellow student,

As a student, you interact with the world in powerful ways that previous generations would hardly recognize. Portable computers and smartphones enable you to remain in constant communication with the world, sending and receiving information in seconds. As a college student, you may be involved in a group that equips you with skills you’ll need for a successful future in finance, activism, law, or any other career field. Perhaps you’re even interested in founding a company or a non-profit organization. All these communication tools, extracurriculars, and aspirations point to the ascendency of our generation’s unspoken mantra: individual empowerment.

On campus and indeed almost everywhere, our ability to access information and communicate is never more than a click away. Many of us seek to work at companies that are perpetual drivers of innovation and transformation. Our graduation speakers will undoubtedly proclaim our ability to fundamentally change the world. We like to think that we are the most empowered generation in our nation’s history and in many ways this is true. But contrary to the rhetoric of political leaders from both parties, the government is not one of these liberating forces. Far from it.

Although the federal government empowers students to succeed in several ways, such as the Pell Grant Program that provides student loan assistance, these policies pale in comparison to the effects of the current structure of America’s entitlement apparatus. The truth about entitlements and their effects on our generation is unsettling, it is painful, it is inflammatory and perhaps most importantly, it is not well understood. With our financial and political future in the balance, it’s time to face the facts. Incoming retirees’ economic problems, coupled with Social Security’s financial woes, will severely cripple our generation’s prospects. Although there are multiple entitlement programs with structural problems, Social Security in its present form poses one of the largest threats to America’s prosperity because of its scale: it accounted for about 25% of federal spending in 2013.

The federal government has overpromised Social Security benefits to existing retirees and, more ominously, to the 75 million baby boomers approaching retirement. Many believe that by paying Social Security taxes they have directly funded their own future benefits. This is one of the most dangerous fallacies in America. In reality, current workers fund current retiree benefits through a 12.4% payroll tax, split evenly between employees and employers. On the surface, this system may seem efficient. However, since Social Security’s inception, the ratio of workers per retiree has plummeted. In 1950, 16.5 workers funded each retiree; today 2.8 workers fund each retiree and the Congressional Budget Office projects that, in 2030, this ratio will fall to 1.9. My fellow student, this falling ratio does not bode well for any American, regardless of age. As fewer workers become responsible for supporting more retirees, our generation’s economic future (and Social Security’s ability to pay current retirees) will decline, rendering much of our potential unattainable. As we polish our resumes and prepare to enter the working world, it is essential to realize that, compared to when baby boomers and current retirees were in the workplace, each of us will have to bear a heavier burden to support Social Security at current levels. But before we discuss the direct impact on our generation, let’s first examine Social Security in more detail.

The Social Security program is divided into two parts: Old Age and Survivors Insurance (about 70% of enrollees) and Disability Insurance (about 30% of enrollees). In December 2012, average monthly benefits were $1,261.Workers are eligible to receive retirement benefits if they are at least 62 years old and if they have paid Social Security payroll taxes for at least ten years. Current workers pay taxes (currently about 12%, split evenly between employer and employee) that fund benefits for current retirees. The most someone could pay in Social Security taxes in 2014 is $7,254 because taxable earnings are capped at $117,000 in 2014; earnings above this level are not subject to the payroll tax. Therefore, this is a regressive tax because lower-income workers must pay a larger percentage of total income to the federal government. It is also important to understand that Congress cannot set the Social Security budget because it is a mandatory program: the government has to provide benefits for whomever is eligible, regardless of cost. This leaves Congress with indirect options such as setting eligibility rules and benefit levels to indirectly influence the program’s spending levels, which rose to $809 billion in 2013.

Before continuing, it is critical to distinguish between the goals of entitlement programs and the methods by which they achieve them. President Roosevelt described Social Security as a “law which will give some measure of protection to the average citizen and to his family against the loss of a job and against poverty-ridden old age.” President Roosevelt is correct; a well-functioning public safety net is an essential element of any society. Current and incoming retirees paid payroll taxes during their careers and America cannot renege on its moral and legal obligation to keep seniors out of poverty. This view is not limited to liberal Presidents. F.A. Hayek, an intellectual icon of the modern conservative and libertarian movements, strongly supported a basic safety net in his widely read political treatise The Road to Serfdom: “Nor is there any reason why the state should not help to organize a comprehensive system of social insurance in providing for those common hazards of life against which few can make adequate provision.”

In addition to the moral and legal obligation our government has to honor its commitment to pay retirees, there are also countless stories that illustrate the more tangible argument for safety nets. Val Jack, of St. Helens, Oregon, described his experiences with Social Security to the Alliance for Retired Americans. His dad, a mechanic and World War II veteran, worked for most of his life on a modest income. At 70 years old, his father retired and began collecting Social Security. The family had saved a reasonable amount of money, but medical bills quickly depleted most of the money Val’s parents saved. His parents were forced to live almost entirely on a small pension and Social Security. Similar stories are very common across the United States. A third of seniors rely on Social Security for 90% of income; two-thirds rely on it for over 50% of income. According to a Congressional Budget Office measure of poverty, 16.1% of Americans live below the poverty line and this percentage is on the rise. A safety net is an absolute necessity in any country.

However, too often, those who wish to change how (not if) the system serves senior citizens are vilified and branded as enemies of the concept of a safety net. As a generation, we must understand this difference because, in its current form, Social Security is unsustainable. Reforming Social Security is saving Social Security; leaving it untouched is sentencing the program to certain death. To ensure that Social Security can continue to protect baby boomers, our generation, and our children, the program has to be reformed. We cannot simply cast aside our senior citizens as they have paid payroll taxes for decades, but we also cannot cast aside fiscal reality. Policymakers must develop reform proposals that simultaneously protect senior citizens (albeit perhaps via a new structure) and empower our generation of students and young professionals to flourish in the workplace. The system must change; its goals must remain the same. As we will now see, Social Security will encounter massive systemic problems in coming years due to the dire economic plight of senior citizens.

As 75 million baby boomers enter retirement, they will have severe economic problems. First, the national savings rate has plummeted, implying that people have fewer funds saved for retirement. According to the Federal Reserve, the savings rate in 1980 was about 11%. In December 2013, it was only 4%. Second, due to the recent recession, many baby boomers’ limited savings have been decimated. Even conservative investors that developed portfolios primarily composed of fixed-income assets have been hurt; bond yields have been low relative to historical levels mostly due to the Federal Reserve’s quantitative easing program. The statistics are tragic. In 2009, 15% of citizens 85 years old and older lived in poverty. In 2005, 3% of people aged 75 to 84 sunk into poverty; in 2009 this measure doubled to 6%. The statistics are worse for minorities: 29% of elder Hispanics and 25% of elder blacks were impoverished in 2009. Few have recovered. Without Social Security, 44% of senior citizens would be in poverty; versus about 9% now. Social Security lifts – a difference of 15.3 million Americans lifted above the poverty line. In light of this harsh reality, even senior citizens who currently rely on Social Security payments should support reform that will ensure support for others. Incoming retirees are in for a rough time, and they will understandably use their immense political power to ensure that Social Security continues to provide a high benefit level. There will probably even be pressure to increase benefits: in a National Academy of Social Insurance Survey 75% of Americans favored increased benefits. Is the Social Security system ready?

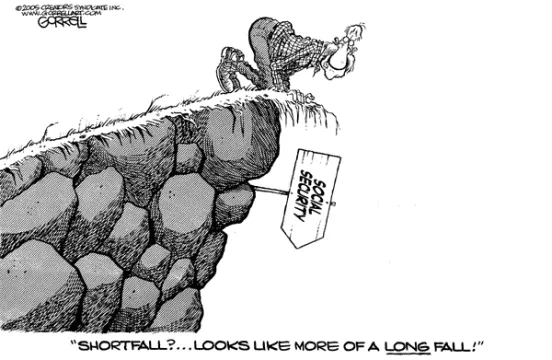

Social Security has traditionally been self-sufficient. Revenues from payroll taxes (about 96%) and federal taxes on current benefits (about 4%) enter a trust fund that is used to pay for benefits. Although the government borrows from this fund to finance other activities, the combination of government bonds and interest on these bonds has usually been enough to meet current obligations. Not anymore. In 2010, for the first time since the program was moderately changed in 1983, Social Security expenditures exceeded the program’s revenues. As more baby boomers retire, this gap will only increase. In 2012, the gap between revenues and expenditures was 7% and, according to the Congressional Budget Office (CBO), the gap will exceed 30% by 2030. We of course seem to have the option to just borrow money to fund the difference between Social Security expenses and revenues. After all, the government does issue bonds to finance a wide array of other activities. But it’s not that simple. Due to legal restrictions, if the Social Security trust fund is exhausted, the Social Security Administration can no longer legally pay all promised benefits. After the trust fund reserves are depleted, experts believe Social Security will only be able to pay 75% of full benefits, and this assumes that costs do not increase faster than expected. The CBO projects this will happen in 2031, although the CBO tends to understate costs as by law, they must use current laws as a baseline when forming projections. The Social Security system is clearly unsustainable on its current trajectory, and unfortunately it stands to leave our generation most vulnerable. Perhaps, in spite of our technological innovation and extracurricular opportunities, we aren’t as empowered as we would like to think.

It’s easy enough to point out how each of us will be required to use a portion of our earnings to subsidize a swelling pool of retirees who have severe economic problems and will demand higher or constant benefit levels from Social Security. The harder goal is to figuring out solutions. The government could cut benefits, but that won’t be politically feasible, especially since the baby boomer generation has immense political power.

Another option then is to raise payroll taxes. There is evidence that the government has few qualms about following this course of action. In 1950, each employee had to pay only 2% to Social Security; now the tax is higher at 6%. Due to a temporary tax cut of 2% in 2011, wage earners only had to pay 4% of their earnings toward Social Security. To avoid the “2013 Fiscal Cliff,” the government let individual taxes rise to their 6% level. Most of America’s 160 million workers were forced to accept smaller paychecks. What is to stop the government from raising these taxes, especially when they have already effectively done so? Add income taxes, investment taxes, state taxes (and states have their own issues that will require higher taxes to solve), and local taxes: the tax burden is already quite high.

82% of Americans believe that Social Security must be preserved even if it means increasing taxes on workers. Furthermore, raising Social Security taxes from 6.2% to 7.6% would probably allow the program to pay full benefits for 75 years, Even though raising taxes may be popular and the increase may seem slight, is it the right policy? Even if Social Security’s ability to pay full benefits is extended, this tax increase will have a serious cost that supporters of the increase may not have considered. Low income households tend to face more spending constraints than higher-income households and increased Social Security taxes would hamper spending in low-income households, hurting many of the businesses in their neighborhoods. In an interview for the New York Times about the payroll tax hike in 2013, Jack Andrews explained how he earns slightly more than $40,000 working at a local factory. Because his wife is disabled, Jack is “the sole breadwinner. Something had to give now that he is earning about $800 less a year, or $66 a month, and it was the couple’s monthly night out.” A “slight” tax hike of 2% caused Mr. Andrews to earn $800 less a month. The average starting salary for the Class of 2013 is $45,327, which is quite similar to Mr. Andrews’ salary. The payroll tax hike constricted Mr. Andrews’ spending and it constricts students’ spending after they graduate college. More ominously, since spending necessities cannot change by much, college graduates will have fewer earrings to save. It is important to note that, since the tax is capped, low-income workers are more severely affected by payroll tax hikes.

Higher payroll taxes will also affect our employment prospects. Most taxes, especially those levied partially on employers, make it more expensive to hire someone, reducing the demand for labor. Many economists believe that the entire 12% tax is passed along to workers via lower wages and employment. In an already volatile labor market, crippled by regulatory uncertainty, health care mandates from the Affordable Care Act, and a failing education system, significantly higher taxes could be devastating. For those of you who inclined to found a company, the facts are grim. Instead of paying a 6% tax, you must pay the full 12% payroll tax since you are an “employee” and an “employer.” A 6% difference can be massive for a startup that is in its earliest stages. This alone undermines the notion that our government empowers us to innovate, but the extent of the situation is even more serious.

Young workers are especially susceptible to labor demand fluctuations because they are typically the least productive due to a lack of office skills and general inexperience. Additionally, we will soon see that, if payroll taxes were raised, low income minority students would be hurt the most. You may believe that America’s youth can absorb elevated tax levels because many of the relatively new tools, such as technology, at its disposal will engender success that no taxes can prevent. However, the facts do not depict an empowered generation that is ready to transform the world and capable of subsidizing a failing Social Security system. Instead, they tell a story about an entire generation that is in critical condition. The story is not just unsettling; it’s shockingly desperate.

Our generation is not empowered; it is suffering from nothing less than the utter collapse of the American Dream. This claim may seem bold, but it is the truth. America’s youth enter a workforce that is not ready or willing to accept them. The notion that a college education is a ticket to success has been shattered. Nicholas Parco graduated from Seton Hall University in June 2012. A month and a half later, he was still jobless despite his best efforts. In an article in the Huffington Post, he describes how he is “a recent college graduate and the son of two hardworking baby boomers, not only do I not have prescription healthcare coverage, but the interest on my student loan bills is higher than that of the mortgage on my parent’s house. Take a second and let that settle in.” College is framed as a path to success yet, too often, it is a path to financial ruin for America’s youth and the issue doesn’t end with college graduates.

Anecdotes fail to capture the problem’s severity. According to The New York Times, 15% of 16 to 24 year olds looking for work are unable to find it. Youth unemployment has remained in the double digits for the last seventy months and has been costing the federal and state governments $21 billion a year. Any child born today has a 22% chance of being born into poverty. 45% of all children below the age of 18 belong to families that are unable to afford basic necessities. Increased payroll taxes would reduce demand for most youth workers and, for low-income minorities, any policy that exacerbates their unemployment should be stopped in its tracks. Of African American teenagers looking for work, 40% are unable to find it. This economic hardship can exacerbate even more serious problems. If a black male dies between the ages of 20 and 24, there is a 50% chance he is a homicide victim; the comparable statistic for white males is 8%. 65% of black and Hispanic children are low income and cannot afford basic necessities. These statistics are only worsening as time goes on.

The short-term facts are horrific, but the long-run trajectory is even worse. Some studies suggest that, due to unprecedented levels of youth unemployment, 18-24 year olds will lose $21.4 billion in earnings over the next ten years. Reduced earnings will reduce tax revenues, increase welfare spending, and decrease revenue streams to Social Security, exacerbating the funding problem we saw earlier. In 2000, the labor-force participation rate was 67%; it is now 60%. A declining labor force implies either that people have grown discouraged or ceased looking for work or that retirement is accelerating (or both). Neither of these trends bode well. A permanently discouraged youth workforce will have drastic effects on the United States’ economic productivity for decades. NPR referred to this crisis as a “ticking time bomb,” but as demands on Social Security increase, there will be immense political pressure to raise taxes to fund it regardless of the fact that higher taxes will make it more difficult for youth to find work and prosper.

We are the most inexperienced members of the labor force and any policy that makes it more expensive to hire us will only worsen these sobering statistics. We are risking stunting our own hopes, dreams, and economic potential to fund current entitlement programs. We have seen how the worker per retiree ratio is declining. Given the above statistics, how can each member of our generation also subsidize a larger share of Social Security? Given the above statistics, how can anyone possibly contemplate raising payroll taxes? Given the above statistics, how can we avoid reforming entitlements so that our generation will also be able to access America’s safety nets? Senior citizens cannot be cast aside, but we also have a moral obligation to alleviate as much of the burden on America’s youth as possible.

I do not intend for you to turn against senior citizens nor do I intend for you to walk away with distaste for the concept of Social Security. It is too important a program not to save. Instead, we must understand the critical problems that will affect our generation in the near future. As we enter the workforce, we will still be empowered by new technologies and by new ideas. However, each of us will have to support a larger amount of retirees due to Social Security’s problems and our ability to use our new tools will be severely hampered by fiscal reality. John Locke claimed, “the only defense against the world is a thorough knowledge of it.” It is time that we employ Locke’s defense. As a generation, we have enormous potential. We must understand the forces that will prevent us from realizing it.

Sincerely,

Brandon Camhi

Feel free to contact me via email: bcamhi@stanford.edu