Table of Contents

Bitcoin has gained notoriety as the currency for criminals. The cryptocurrency has been historically associated with black markets such as Silk Road, and identification of users is difficult due to Bitcoin’s combination of cryptography and a peer-to-peer architecture.

Bitcoin has gained notoriety as the currency for criminals. The cryptocurrency has been historically associated with black markets such as Silk Road, and identification of users is difficult due to Bitcoin’s combination of cryptography and a peer-to-peer architecture.

Despite its reputation, Bitcoin was not specifically designed for illegal activities in mind. Rather, it was designed as a new form of money that uses established cryptography in novel ways in order to make it possible to transfer ownership of currency directly, rather than through a central authority.

On May 1, Self-proclaimed anarchists Cody Wilson and Amir Taaki released a new tool called Dark Wallet that takes financial privacy to a whole new level. Dark Wallet allows users to easily add extra layers of privacy and anonymity to their Bitcoin transactions. Their promotional video features Taaki holding a 3D-printed gun, a glimpse of the Dark Wallet logo, and an out-of-context quote from Obama, telling Bitcoin users and potential developers “don’t just download the latest app; help design it.”

Because Bitcoin is not inherently illegal, the government generally has made little effort to directly stop people from participating in Bitcoin transactions. The Federal Reserve Advisory Committee has a positive stance on Bitcoin’s potential: “Its global transmissibility opens new markets to merchants and service providers.” Instead, several government agencies have proposed stricter regulation of Bitcoin, which has increased tension between some Bitcoin users and the government. In early May, the SEC issued an Investor Alert to warn about the “frauds and high-risk investment opportunities” behind investing in Bitcoin. The IRS similarly declared that virtual currency is treated as property for U.S. Federal Tax purposes, meaning that “wages paid to employees using virtual currency are taxable to the employee…and are subject to federal income tax withholding and payroll taxes.”

Although it is good to critically evaluate tax rates and government regulatory policy, programs that skirt established regulatory rules are contrary to the rule of law and order. There is already legal confusion about how and when to tax online transactions, but Dark Wallet would make taxation on its users’ Bitcoin transactions impossible. In 2009, the Supreme Court declined to hear a case that would argue New York’s ability to tax Amazon sales to customers in the state. This decision left it to Congress and state legislations to decide how to tax online purchases. However, widespread adoption of Dark Wallet would nullify these discussions, as the technology makes it nearly impossible for the government to trace the parties involved in Bitcoin transactions. The IRS report claims that “a payment made using virtual currency is subject to information reporting to the same extent as any other payment made in property,” but Dark wallet makes it nearly impossible to enforce these laws.

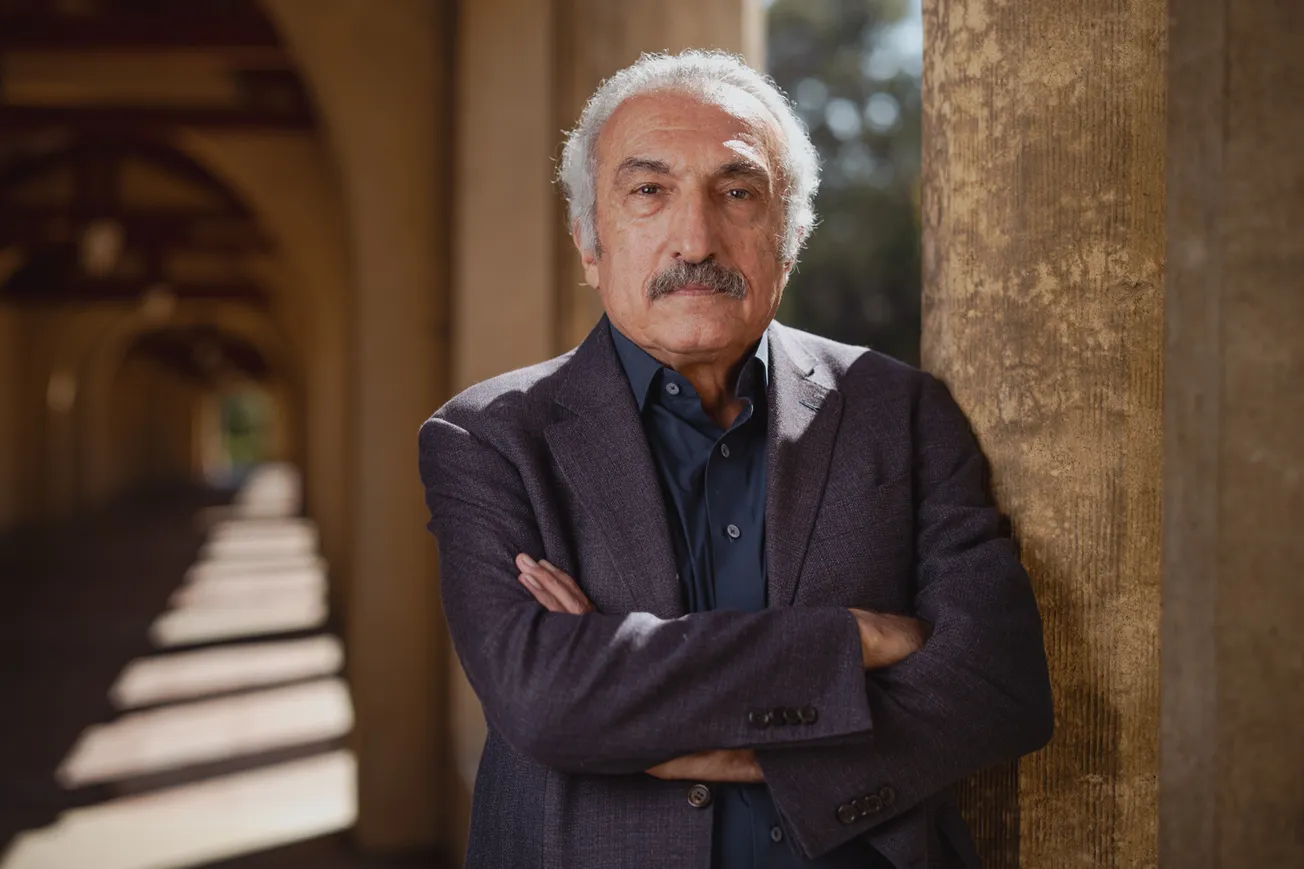

Joe Grundfest, Professor of Law and Business at Stanford Law School, highlighted that Dark Wallet cannot peacefully coexist with the current legal system. “In the context of contemporary U.S. financial markets, anonymity is incompatible with a range of ‘know your customer’ rules and anti-money laundering rules.” Because Dark Wallet’s purpose is to disallow tracing of transactions and traders, it further debilitates tracing of money launderers that use Bitcoin trading. Thus there would not be any possibility of banning certain individuals from trading, making it necessary to have cryptocurrency trading be an unalienable and un-investigatable right. While anonymity has its value in protecting whistleblowers and journalists, it would act as a loophole in the current US financial system.

Complete anonymization of Bitcoin transactions would hinder not only the government tax regulations, but also other government financial tools. John Backus and Andy Bromberg, members of Stanford Bitcoin Group, pointed out that a government of a society widely using cryptocurrency is unable to impose a capital levy — a one-time percentage tax on all savings — on its citizens. For example, in March 2013Cyprus’ government instituted a 6.75% capital levy on savings below €100,000 and a 9.99% levy on savings above €100,000. Many citizens of Cyprus responded by adopting Bitcoin after losing faith in their local banks. Bitcoin was a useful currency for citizens who were concerned that their bank funds may be frozen, as the government had no way of tracking transactions or instituting capital levies. In this sense, pseudonymous transactions would protect individuals in repressive states from authoritative governments. However, in democratic nations with a tax system, there cannot be circumventions of rules to ensure integrity of the tax system.

Not all Bitcoin users and institutions are unwilling to comply with the government. Many Bitcoin institutions already aim to comply with U.S. federal standards as much as possible. For example, Coinbase, a hosted Bitcoin wallet that allows users to buy and sell Bitcoin from their reserves with 1,200,000 consumer wallets, has a history of compliance with the government. Bromberg explained that “neither Dark Wallet nor Coinbase are reflective of Bitcoin as a whole.” While Coinbase tries to please Bitcoin users and government regulators alike to maximize profits, Dark Wallet makes no such concessions as it was motivated by ideology. “Dark wallet will not comply because compliance is not the point. The creators of Dark Wallet want to remove the government from the equation,” Backus said.

It is uncertain whether anonymizing systems like Dark Wallet will survive regulatory legislation. Grundfest noted, “The future of systems that allow for easy evasion of these regulatory requirements is thus questionable, particularly if these systems become large enough to attract regulatory attention.” All signs point to cryptocurrency becoming as large as Grundfest says — a report by Blockchain.info shows a sharp rise from 7,000 daily Bitcoin transactions two years ago to 70,000 daily transactions in May 2014. Dark Wallet is a technological and cyber-libertarian victory, but it lowers the bar for stealth Bitcoin transaction techniques that were previously only possible for experienced users.