Table of Contents

Our new “The Heart of the Matter” series features interviews with experts on either side of a controversial issue, asking each the same questions to see where and on what grounds their arguments diverge. Participants are asked to limit their responses to 1-3 sentences.

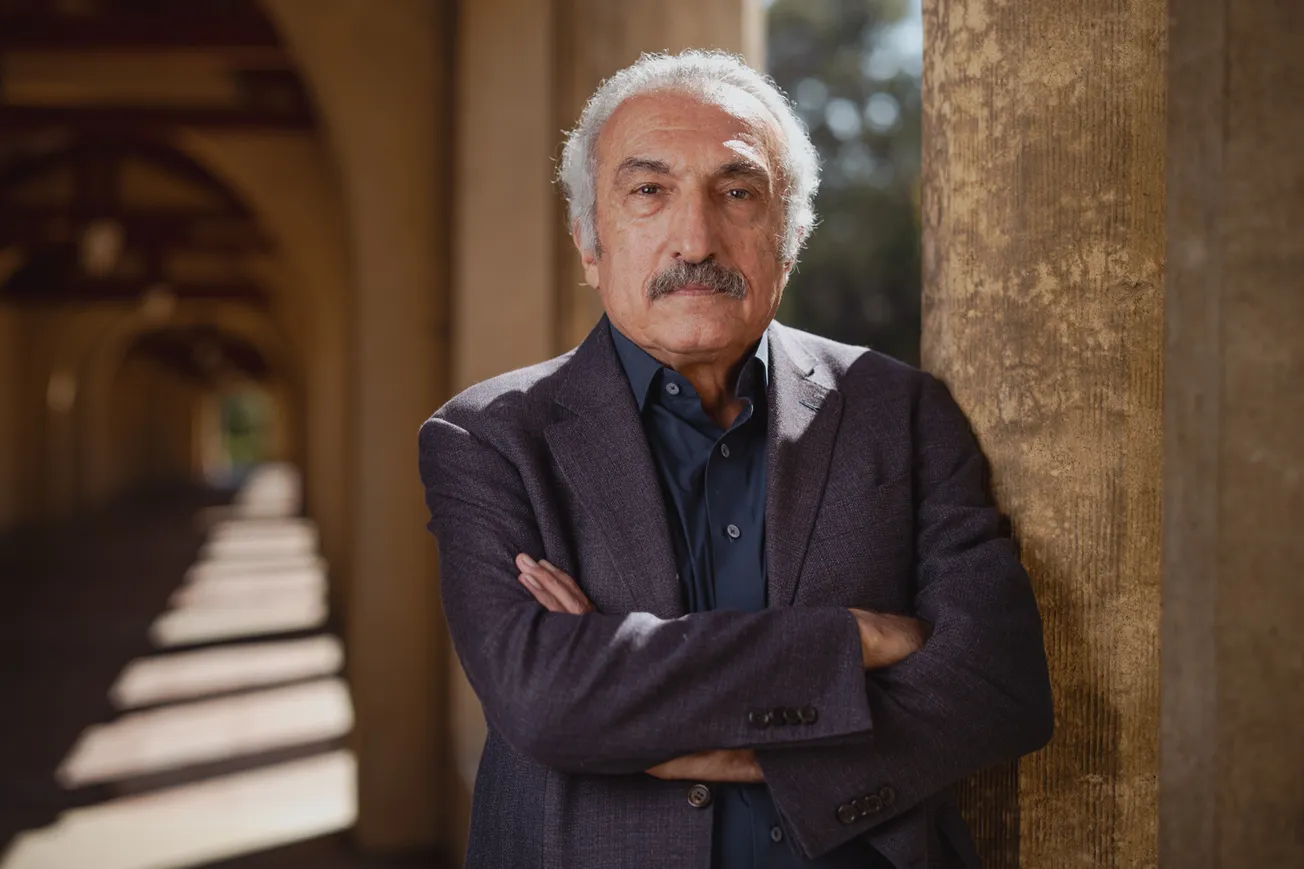

Arguing in favor of free trade is Dr. Kenneth L. Judd, Paul H. Bauer Senior Fellow at the Hoover Institution. Opposing him is Dr. Paul Craig Roberts, former Assistant Secretary of the Treasury for Economic Policy and former Senior Research Fellow at the Hoover Institution.

Introductory Comments:

KJ: I first want to thank the Stanford Review for asking me to participate in this exchange. The main theme of my comments is that the world economy is dynamic and constantly changing, and that the best way to go forward is to have workers and capital move to best take advantage of changing opportunities, no matter what the cause. The only exception is where national security is threatened, but this is almost never a legitimate concern.

Change will always create losers, but the winners’ gains are generally substantially larger. It is better to allow the winners to get their gains but require them to share some of the gains with the losers through policies like unemployment insurance. Impeding free trade is generally a poor way to accomplish any goal.

PCR: I have always been a free trade, free market economist, but not as an ideologue. The classic case for free trade has always rested on the Ricardian conditions without which the case is invalid. Since the rise of knowledge-based production functions, the development of the high speed Internet, the collapse of world socialism, and the erosion of nationalist sentiment among corporations, the necessary conditions for free trade have not existed in the real world.

Moreover, in 2000 MIT Press published Ralph Gomory and William Baumol’s Global Trade and Conflicting National Interests which shows that the case for free trade has been invalid from the start regardless of the presence or absence of the Ricardian conditions. Offshoring is not an issue of protectionism vs. free trade or of fair trade. Offshoring is a new challenge as yet unrecognized by economists.

1.* For the American layman, what is free trade in theory? What’s the relationship between it, comparative advantage, and the mobility of capital and labor?*

KJ: If people are allowed to trade with each other, then each person can focus on doing what he does best, acquiring other goods by trading with those who are efficient at producing those goods. This is true for people in different cities, different states, or different countries. Free trade accomplishes this without significant movement of people or capital, movements that are often costly for social, political, cultural and physical reasons.

PCR: Free trade theory rests on the principle of comparative advantage, which says that there are gains from trade (over self-sufficiency) if countries specialize in economic activities where they have comparative advantage. There are two necessary conditions for comparative advantage: capital must be relatively immobile internationally, that is, capital must seek comparative advantage at home and not pursue absolute advantage abroad, and countries must have different relative cost ratios of producing tradable goods. Free trade theory originated two centuries ago when businessmen kept their capital under their supervision in their own country and traded goods were largely products of climate and geographical location which varied by country.

2.* Do the theoretical conditions necessary for free trade to be the optimal policy exist today? In other words, is free trade something the US should generally pursue with other countries?*

KJ: The theoretical conditions underlying academic arguments for free trade do not exist today and will never exist in the real world. However, no one has demonstrated that the current conditions are so far from the ideal that we should deviate significantly from the free trade ideal. In fact, almost all analyses of specific policies that impede trade find that the costs far outweigh the benefits.

PCR: Neither of the two necessary conditions for comparative advantage exist today. Capital is as internationally mobile as traded goods, and knowledge-based production functions operate the same regardless of location.

3.* What is the relationship between America’s historical rise as an economic powerhouse and free trade?*

KJ: International trade has always contributed to economic growth, but the best example of the success of free trade is the constitutional prohibition against any state imposing duties on goods “imported” from other states. Many states would have tried to interfere with interstate trade, but all benefited from this mutual agreement to allow free interstate commerce.

PCR: America’s rise as an economic powerhouse was based on tariff protection and on the destruction of competitors’ productive capacity by world wars, socialism, and communism. Following World War II, the US was the only country with an intact economy. In the postwar period the US government undermined American economic hegemony by using trade to create wealth abroad as a check on communist expansion.

4.* Proponents of “fair trade” say that many players in the world market break the rules of free trade—Japan dumping TVs on the US market, the EU subsidizing Airbus. In short, we play by the rules and everyone else cheats, ripping us off in the short- and long-run. How “fair” is this critique?*

KJ: Dumping is not a major factor and is often exaggerated by using average cost instead of marginal cost to determine whether a product is being dumped. Subsidies are also not a major factor, and any serious effort to prohibit them could hinder desirable government subsidies for, say, scientific research that improves our competitiveness.

PCR: In the US free trade has become an ideology, while our trading partners look to their material interests. This said, I do not think the “fair trade” argument is the real issue. The issues are that the conditions on which free trade depends do not exist, that Ralph Gomory and William Baumol have shown that the free trade theory was incorrect even when the necessary conditions did exist, and that offshoring is not trade but labor arbitrage across international boundaries.

5.* The American layman is likely to be confused about outsourcing. On the one hand, he is told that millions of jobs are being exported overseas; on the other, that millions of jobs are being insourced. In terms of sheer numbers, what does the scale look like at the end of the transaction? What kinds of jobs are being exchanged?*

KJ: We do not have good numbers on these effects since it is difficult to determine exactly why a job was lost or why one is created, but these numbers distract us from the key facts. Millions of jobs are destroyed and created each year, most for reasons having nothing to do with trade, and our focus should be on quickly moving workers whose jobs disappear into new jobs better suited for the new economic conditions.

PCR: Jobs insourcing is a myth, but offshoring is not. The collapse of world socialism and the rise of the high speed internet has made it possible for companies to use foreign labor in place of domestic labor to produce products for their domestic markets. The large excess supplies of labor in China and India mean low wages and reduced costs of production for firms that offshore their output. Payroll jobs data supplied by the Bureau of Labor Statistics show that in the 21st century the US economy has been able to create net new jobs only in nontradable domestic services.

6.* How serious, if at all, is the loss of American manufacturing? Is it true that the job losses seen in manufacturing are simply the outcome of greater efficiency rather than outsourcing?*

KJ: Increases in efficiency have surely been the major factor. Trade is a factor but partly because the American worker is better educated than workers in most other countries, making it wasteful for an American worker to do the low-skill, low-wage work that is now done elsewhere.

PCR: Entire occupations are being lost to offshoring, including middle class professions formerly filled by university graduates. The majority of the jobs in the BLS forecast for the next ten years do not require a college education. The ladders of upward mobility that made the US an opportunity society are being dismantled.

7.* The American layman is also likely to be confused about the trade deficit, which currently stands at roughly $800bn per year. On the one hand, he is taught in Boy Scouts and by his family that massive long-term debt is something to avoid. On the other, he is told that the deficit is manageable, that it isn’t a problem. Is the deficit a problem? Will it shrink or grow?*

KJ: The current levels are probably not sustainable and will demand some adjustments, but they are arguably manageable when we consider temporary factors and the fact that we should never expect to get deficits down to zero. The US Federal government deficit is large but falling, and income on foreign investments is generally underreported. Moreover, the rapid growth of world trade leads other countries to sell us their products and happily use the paper we send them to increase their reserves of dollars and holdings of other US liabilities.

PCR: The offshored production of US firms counts as imports, thus increasing the trade deficit. Princeton University economist Alan Blinder estimates that there are 30 to 40 million high end middle class service jobs that can be lost to offshoring (or to cheaper foreign labor imported on work visas). As offshoring converts domestic GDP into imports, the likelihood is that offshoring will drive the trade deficit higher and further erode US economic growth.

8.* What is the relationship between increased foreign-control of American assets—shopping malls, apartment complexes, corporations, etc.—and the trade deficit? Is this something to be concerned about?*

KJ: One way we pay for our imports is to sell assets to foreigners. I am not concerned since, due to their desire to maximize profits on their investments, they will manage those assets in much the same way an American owner would, and I don’t worry about them moving these assets to some other country.

PCR: The $800 billion trade deficit means Americans are consuming $800 billion more than they produce. Americans pay for this consumption by giving up ownership of existing assets and all future income streams associated with these assets, thus worsening the current account deficit in future years.

9.* As in many economic transactions, there are winners and losers in free trade. In the end, do the gains outweigh the benefits? Are the losers compensated?*

KJ: In the short-run, there will be losers from growth in trade, but the gains dominate. The extent of any compensation is determined by political factors with losers seldom being fully compensated, but this is the case whenever the government responds to any situation with losers and winners.

PCR: Offshoring presents economic theory with a major challenge as offshoring breaks the connection between the profit motive and improvement in the well-being of citizens. Offshoring increases shareholder returns and the performance-based incomes of executives at the expense of middle class jobs and domestic GDP growth. Susan Houseman has shown that US productivity gains are really measuring labor cost savings from employing low-wage foreigners in place of Americans and that this is the reason the US has had no increase in real median income despite high measured productivity growth.

10.* All things being equal, given present trends, will Americans be better off or worse off in twenty years?*

KJ: Americans certainly can be better off in twenty years. Free trade policies will help, but the future depends much more on educating our workers and making sure that they have the capital they need to use that education.

PCR: Offshoring is closing the American dream. In 20 years the US will have a third world work force engaged in nontradable domestic services. Offshoring is poorly measured in US statistics, and there is evidence that US GDP growth is exaggerated by including the offshored production of foreign labor.