Table of Contents

The marketplace is always begging the question of whether a company is too big and therefore a monopoly. Many feel Apple – now the most valuable company in the world – is generating an incredible profit, enough to erect a new UFO-shaped HQ. Meanwhile, Google is slowly taking over the world with Google Cars, Fiber, Glass, and now Project Loon. They are the world’s greatest tech titans, and it’s hard to believe that they could ever fall. However, they have competition, and as long as competition thrives, innovation follows.

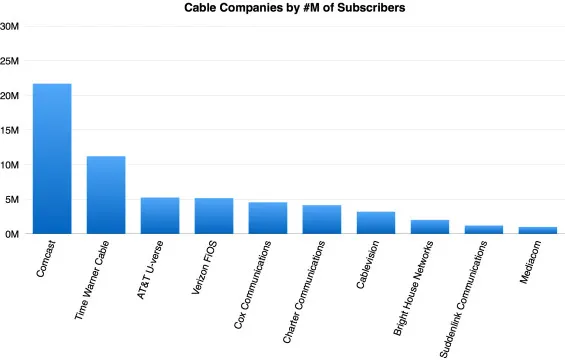

Last month, Comcast confirmed its $45B merger proposition with Time Warner Cable (TWC). Other companies interested in talking with TWC included Charter Communications, Cablevision, and Cox. A similar merger has been a topic of ongoing debate between DirecTV and DISH Network, which will likely be reignited now that they’ll have to compete with a combined Comcast and TWC.

This large-scale event invited some concerns over whether antitrust laws should apply to Comcast’s decision, which is one of the largest merger proposals of our time. If approved by the Federal Communications Commission (FCC) and the Department of Justice (DOJ), the deal will make Comcast, already the largest cable company in the U.S., even larger.

The companies are likely to point out that they don’t directly compete in terms of regional penetration and thus consolidation would not affect existing competition. Comcast’s 21.7 million subscribers are concentrated in Philadelphia and Washington, D.C., while Time Warner Cable’s 11.4 million subscribers are found primarily in New York and North Carolina. This lack of overlapping markets may mitigate antitrust concerns and reassure hopes of ongoing cable competitions. Thus, the bar chart above is potentially misleading, since larger numbers of subscribers do not correlate with monopolistic advantage, keeping in mind differences in regional penetration.

There will, of course, be opposers who believe that this merger would be fatal for the TV industry, and will result in a less consumer product choice. But when we look at the bigger picture, one can argue that there’s already a monopoly in the TV market – Comcast – with twice as many subscribers as TWC; one corporation owning more subscribers in a market outside of its own competitive zone will therefore not make much of a market difference.

Yes, antitrust laws are in place to help shelter and provide a safe haven for smaller business operations to grow, let alone initiate. These regulations handicap existing corporates from pushing smaller or mid-sized business ventures and entrepreneurs out of the picture, so that there is not any one dominant giant over a particular marketplace.

However, from an optimization perspective, by applying these laws and thereby splitting monopolies, the market economy will converge at a local minimum and therefore never realize its fullest potential. What this means is if we restrict the market’s expansion when it is at its strongest growth, we would be dragging down a rocketship; there will be a lack of motivation and hunger for any market to ever try to dominate, thereby giving no room to exploit one’s fullest capabilities. Competitors will always be saved from losing out and having not just a second chance, but also the opportunity to be on equal terms with others. This idea is quite the opposite of a free, capitalistic society.

In the past, there have been circumstances that question whether antitrust laws are valid in similarly controversial, monopolistic events. Google was once accused of prioritizing their products in searches, resulting in their forced business decision switches; a large-scale AT&T/T-Mobile merger once led to public skepticism and fear of a corporate service being too massive; and at one point Apple and Time Warner Cable were negotiating to bring the cable provider to the Apple TV. Can we confidently say that antitrust laws also apply to Comcast’s acquisition?